Bruno D. Castanheira works with the European Commission in securing the Union’s financial interests, having previously worked to improve implementation of Regional Policy. His research to stabilise European Economic Integration explored new approaches to Regional Policy and the role of financial instruments in Cohesion founded on behaviourist, industrial and financial economics. You can find him on twitter at @BrunoDuarte_, or connect with him on LinkedIn or his own blog.

A framework for a Eurozone budget

As seen in previous posts, a Eurozone budget to promote convergence and competitiveness must tackle the divergence of inputs, outputs and income across the Union; it must consider different levels of the capital-labour elasticity of substitution and of product market competition, the policy interest rate; and it must intervene to improve human and physical capital, institutions and production technology.

In respecting and leveraging the stabilisation role of the SGP, the Eurozone budget should focus on narrowing the dispersion of output gaps while delivering bespoke programmes to each Member-State’s circumstance. The mix of product-market competitiveness reforms and investment should consider each Member-State’s real interest rate and labour market slack, and the effect investment or reforms would have on input factor allocation.

A plausible set of reforms applicable across the Union would aim at increasing Total Factor Productivity. Relying on the World Bank and on the consistent observations by CEPR’s Dalia Marin, improving TFP involves improving management practices and structures while establishing links to transfer skills between subsidiaries located in different Member-States.

The European Commission should issue concrete guidance to narrow the gap in ULC, namely indexing wages to productivity growth.

In what concerns closing the dispersion of output gaps, policy must act both structurally and economically. Structurally, the Eurozone budget could fund actions towards completing the Single Market aiming at improving product market competition. Economically, improving capital availability (considering capital markets integration) while implementing a contained fiscal policy depresses real interest rates that contribute to narrow a positive output gap – but such policies are not equally recommendable to economies with positive or negative output gaps, nor if the economy replaces or complements capital with labour.

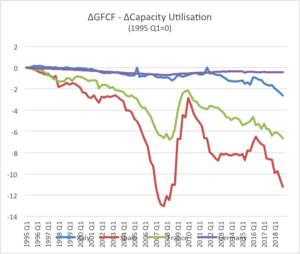

As seen in the previous post, a policy mix to close negative output gaps met with high (positive) real interest rates includes product market reforms that enhance competition and exclude uncompetitive firms. Such is the case of France, Italy and Spain where fiscal stimulus would further expand the negative output gap. Firms in these economies should benefit from improvements to managerial skills and production technology that increase capacity utilisation and a decelerated depreciation schedule over the medium-term (considering high real interest rates).

Figure 1. Accelerated Depreciation Schedule.

Conversely, economies such as the German where a positive output gap combines with a negative real interest rate imply lower investment rates than necessary to avert inflationary pressures. Again, reforms that encourage investment such as a tax break, an accelerated depreciation schedule or an effective stimulus to investment would benefit these economies.

Conclusion

Fiscal constraints imposed by the SGP compound public and private sector indebtedness trends and further appeal to a stabilisation function of the Eurozone budget. Each Member-State is compelled to present fiscal spending adjustments that annul the possibility of using fiscal policy to increase the real interest rate (demand stimulus) or fund investment (supply stimulus for those output gap economies with negative real interest rates).

Keeping a (near) zero output gap and deleveraging as main objectives to ensure convergence and competitiveness, a stabilisation and convergence Budget is most effective if it compensates the cost of reforms and only subsequently funds investment.

Different capital-labour structures are at the core of diverging output gaps and asymmetric shocks. Member-States should consider these structural differences when programming stimulus. A convergence, competitiveness Budget with a stabilising effect should deliver indirect benefits to product-market competitive economies and direct benefits to non-competitive economies, to ensure gains to both acceding Member-States and incumbents. For instance, collaborative funding in H2020 could enforce Cohesion-Competitiveness collaborations that delivers co-development of high-skill sectors.

Neither Horizon Europe nor the post-2020 MFF explicitly consider the need for “competitive convergence” that ensures both product-market growth and (relatively) higher wages for low-skill work. Whereas capital investment has been primed in Cohesion and Competitiveness funds, research shows that skill upgrading is not only a product of technology transfer but also of knowledge transfer. The EU should embrace an ambitious skills transfer programme along the value chain, similar to supplier development programmes developed elsewhere including in Portugal.

From a structural perspective, and considering the difficulty in allocating non-inflationary stimulus effective to close the output gap, the Union should focus on increasing intra-industry integration – as it otherwise risks broadening the income gap between Member-States and reducing Union-wide welfare.

Are you currently involved with regional research, policy, and development, and want to elaborate your ideas in a different medium? The Regional Studies Association is now accepting articles for their online blog. For more information, contact the Blog Editor at RSABlog@regionalstudies.org.