Bruno D. Castanheira works with the European Commission in securing the Union’s financial interests, having previously worked to improve implementation of Regional Policy. His research to stabilise European Economic Integration explored new approaches to Regional Policy and the role of financial instruments in Cohesion founded on behaviourist, industrial and financial economics. You can find him on twitter at @BrunoDuarte_, or connect with him on LinkedIn or his own blog.

A Eurozone budget: funding competitiveness and convergence

Member-States that remove barriers to cross-border capital and goods movements deliver significant gains to firms and citizens: removing barriers such as high transaction fees improves price transparency and increases arbitrage, pushing incumbent firms to cut price-cost margins, lowering relative prices. In acceding Member-States, firms benefit from improved access to Foreign Direct Investment that accelerates the pace of structural change.

Asymmetric gains of the Single Market (of market size to incumbents, of access to capital markets to new entrants) pose a challenge to policy makers. For instance, the ECB finds converging per capita income requires both developing high-skill industries and adequate institutional framework that maximises the benefit of increasing human and physical capital in acceding Member-States. Member-States that fail the transition on either may be caught in a “non-convergence trap” that, according to Aghion and Acemoglu, is often the result of feeble institutions and vested interests that hamper competition.

Such vested interests act upon both incumbent and new entrants’ institutional setup: for instance, a study to the European Parliament found that the EU’s research agenda may in fact prevent converging Member-States from catching-up by hampering knowledge dispersion and absorption. Policy makers are aloof of such effects as the most common measure of convergence, beta convergence (comparing the paces of GDP growth) is not as representative as sigma convergence (measuring the dispersion of GDP amongst Member-States) in capturing how even fast growth is insufficient to produce convergence.

Hence, a competitiveness and convergence Budget must invest to foster convergence of input levels and deliver competitiveness gains to both incumbents and new entrants (productivity gains delivering higher wages in the latter mean expanding, wealthier markets to the former) by encouraging both factor accumulation and institutional reform. Such Budget must finance investment in human and physical capital, technology and institutional quality – “structural reforms and public investment” – to mimic the pro-cyclical component of fiscal integration suggested by Peter Kenen.

Human capital and physical capital: empirical observations

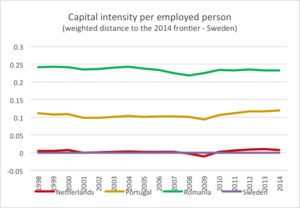

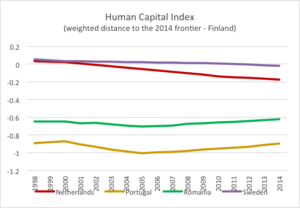

On convergence, the following two charts use AMECO, Eurostat and FRED data to plot progress in bridging the distance (difference) to the EU frontier of the human capital index (HCI) and of capital intensity per employed person. The charts weigh both indicators by GDP per capita and population: smaller economies in the sample welcome less foreign direct investment (Eurostat, own calculations), and investment in education is less onerous in countries that are more populous, thus gains in less wealthy/smaller nations are proportionally more relevant.

Figure 1. Capital intensity per employed person.

Figure 2. Human Capital Index

The four countries plotted are similar in population size (Netherlands/Romania, Portugal/Sweden) and either use the Euro or are yet to replace national currencies or become members of the ERMII.

The effects of Euro membership are graphically and statistically observable in capital accumulation (the correlation between capital intensity of Euro area members is about double that with Romania). Portugal and Romania are even more capital intense than their GDP would lead to assume perhaps due to the quadratic relationship between capital intensity and output (statistically significant in both Member-States, even if Portugal’s capital intensity/GDP per capita begins exhibiting a non-quadratic relationship) and the importance of managerial skills in increasing output.

The effects of the Single currency vanish when considering human capital: wealthier Member-States exhibit positively correlated progress between each other and negative correlation with Portugal and Romania that converged with Finland at similar paces.

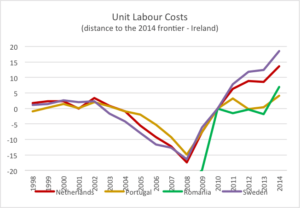

Turning to competitiveness, research suggests Unit Labour Costs (ULC) correlate with both capital intensity and human capital. Regressions on this sample exhibit significant positive/negative coefficients only with capital intensity hence, considering the quadratic relationship described above, the chart plots distances to the frontier without weights.

Figure 3. Unit Labour Costs

Neither regressions nor plot show unequivocal links between ULC and inputs to production, hinting at other intervening variables such as institutional setup and technological development in determining how convergent capital levels translate into convergent growth.

Beyond (human and physical) capital: institutions and technology

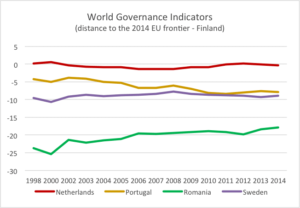

The World Bank’s Worldwide Governance Indicators is a set of 36 indicators across six dimensions measuring institutional quality. The chart below plots an average of these indicators for the sample. The correlation between Member-States’ path is either negative or very small and apparently unrelated with either Euro Area membership or income.

Figure 4. World Governance Indicators

Another plausible explanation is a persistent difference in technological structure that renders productivity lower albeit gains in human and physical capital relative to the European frontier.

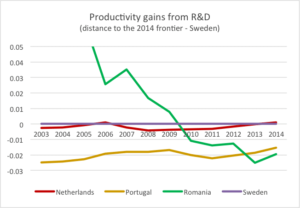

If the technological structure of a Member-State’s industry underpins its growth path, then it should be visible in the distance of the ratio of productivity gains to R&D investment intensity regarding the European frontier of innovation in 2014 (Sweden).

The ratio of R&D investment to productivity gains positively correlates across the sample, more so between wealthier Member-States.

Figure 5. Productivity gains from R&D.

As expected, productivity in economies growing from a lower base (Romania) or closing the gap (Netherlands) with the leader catch-up at different paces, with Romania’s rapid gains waning to a larger distance from the frontier than Portugal.

A Eurozone Budget’s privileges institutional reform, technological convergence and human capital improvement. The following post shall sketch the Budget’s link with the Union’s Fiscal Rules.

Are you currently involved with regional research, policy, and development, and want to elaborate your ideas in a different medium? The Regional Studies Association is now accepting articles for their online blog. For more information, contact the Blog Editor at RSABlog@regionalstudies.org.