Bruno D. Castanheira works with the European Commission in securing the Union’s financial interests, having previously worked to improve implementation of Regional Policy. His research to stabilise European Economic Integration explored new approaches to Regional Policy and the role of financial instruments in Cohesion founded on behaviourist, industrial and financial economics. You can find him on twitter at @BrunoDuarte_, or connect with him on LinkedIn or his own blog.

Marianna Mazzucato is a brilliant economic researcher frequently hired by European innovation policy-makers to advise on neo-Schumpeterian social market economy policy.

I haven’t finished reading Mazzucato’s work, as an intelligible argument for broader audiences requires extensive recapitulation, but did find an interesting piece by two economists that criticise Mazzucato’s approach to finance.

According to Alberto Mingali and Terrence Kealey, Mazzucato’s assertion that the State’s control of currency (a Modern Monetary Theory approach to money) means that returns on research that depend on the “gravity” of each investment project are bound to fail because “gravity” implies loss of perspective.

The mobilisation of public and private resources to coordinated venture and entrepreneurship contributes, according to these two authors, to a loss of critical signal that corrects and even dismantles venture initiatives when the venture does not follow its mission, or when its negative externalities supplant its intrinsic benefits.

According to the authors, private sector signalling explains the success of North American Universities and Government ventures in scientific research. Signalling is a fundamental mechanism of competition for both consumers and investors and is at the crux of a more competitive social market economy.

The EU’s social market economy owes its competition concept to Smith and Ricardo’s aversion to rentiers and distorted competition. For instance, subsidising ventures instead of fixing prices maintains the market signal needed to moderate the cost of sustaining citizen welfare, social market economy’s relevant contribution to market theory.

Lower welfare costs require fair social costs instead of excessive taxation. According to Mingali and Kealey, this compares with Mazzucato’s call for insatiable resources invested on Mission Science and research that impose significant burden on tax payers and mute the price signal.

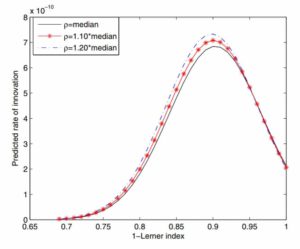

Accordingly, Kilponen and Santavita find innovation decreases with feeble/excessive competition as high/low margins guarantee/inhibit returns on investment.

Bronzini and Piselli find that subsidies are the most effective instrument in increasing the probability of small firms applying for patents. Syneornidis, for the OECD, finds that firm size is negatively correlated with competition and innovation, and suggests that carefully crafted innovation costs may lower entry costs of firms, while also alerting us that certain industries are necessarily more concentrated (as a by-product of high fixed costs) and should entice flexibility from competition regulators. This latter argument underpins the French-German manifesto to reshape European competition policy in the aftermath of the European Commission’s Decision to block the Alstom-Siemens merger.

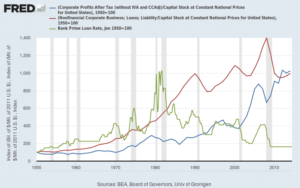

In the United States, less stringent competition rules and diverse signalling channels (namely a more active investor signal, compared to the EU) imply concentrated incumbents increase in size whilst relying on markets instead of Government for value and social welfare signals.

In the EU, welfare spending muffles (crowds-out) both investor and consumer signals, as cost and returns are redistributed to correct the market for those firms and individuals on the right tail of the chart above. As visible in the chart, compensating firms and persons seems the only way to maximise innovation and returns to investment and growth, as may be concluded from both Romer or Jones.

The deliberate compensation of market concentration distortions inextricably links competition and innovation policy. This makes BDI’s and even Mazzucato’s frameworks incomprehensible or at least incomplete.

BDI suggests reappraising merger controls and tax incentives that would further socialise innovation costs, hamper competition and mute market signals, particularly considering how the cost of innovation was, until recently, disproportionate to the returns to capital investment.

Tax incentives to innovation would further mute consumer signals by shifting welfare choice from market to Government. The narrow margin between the weights of tax on output and income (less than 0.5%) in total fiscal revenue hardly qualifies as a distortion worth correcting, particularly considering the fundamental role of investment welfare funds in lowering firm’s funding costs.

In fact, the BDI brief requests both IP protection and an increase in the EU’s innovation funding that, in the framework of suppressed competition and distortionary tax incentives, would further induce concentration and push the innovation index past the hump on the earliest chart.

That is why Mazzucato may have missed the important implications of strengthening incumbent technological solutions that, even if seeded, would necessarily require a more complex regulatory framework to remove the distortion created by the innovation Missions concept.

The concept itself is incremental to other European policy such as Europe 2020. Horizon 2020, shaped to fund the Societal Challenges identified in Europe 2020, discards firm size or location as relevant criteria for fund disbursement: the top funded SME is in fact a hundred-staff outlet managing a network of education and research organisations spanning 38 countries, 10,000 education institutions and 50 million users. Concurrently, no top-10 H2020 recipient Member-State is a convergence Member-State.

What better examples of concentration?

This post intends to motivate a reflection on the outcomes of R&D funding in the EU (charted in the following) because, as BDI claims, “innovation in the EU must be strengthened”.

I believe a blog post I penned to the RSA contributes to achieve that goal.

Are you currently involved with regional research, policy, and development, and want to elaborate your ideas in a different medium? The Regional Studies Association is now accepting articles for their online blog. For more information, contact the Blog Editor at RSABlog@regionalstudies.org.