Professor Ronald Wall holds the Chair in Economic Development of the City of Johannesburg and Gauteng Province, at the School of Economics and Business Sciences (SEBS), University of the Witwatersrand, Johannesburg. His research concerns global and regional economic development, inter-city network analysis and urban planning studies.

This post is written by Ronald Wall, and based on The State of African Cities 2018 – The geography of African investment (UN-Habitat) report. The report was initiated and developed by Ronald Wall (Wits University and IHS-Erasmus University Rotterdam), Alioune Badiane and Jos Maseland (UN-Habitat), and co-developed by Katharina Rochell and Mathias Spaliviero (UN-Habitat). This post represents the views of the author.

Institutions: UN-Habitat, University of the Witwatersrand (SEBS), Erasmus University Rotterdam (IHS), African Development Bank (AfDB), UKAID, Government of Norway and PFD Media Group.

Download: The report can be downloaded from the following link: https://unhabitat.org/books/the-state-of-african-cities-2018-the-geography-of-african-investment/ Please distribute to people and institutions that would be interested.

Introduction

Recently the State of African Cities 2018: The Geography of African Investment Report was launched. According to the report, investors into African cities can play a critical role in the region’s development, noting that SDG 11 (sustainable cities and communities) recognizes the role of cities as productivity hubs that drive growth and attract investment.

According to Aisa Kirabo Kacyira, Deputy Executive Director UN-Habitat, the “groundbreaking” nature of the study is its focus on the economic dynamics of FDI at the city level, which is important considering that by 2030 half of Africa’s population will live in cities, possibly exacerbated by a form of rapid urbanization that is not paired by matching economic growth and inclusiveness. It is also argued that the advancement of African cities is not only important for the continent’s future, but arguably for the entire world.

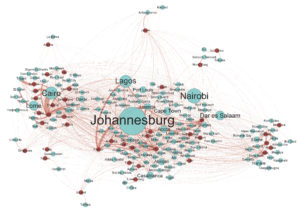

Figure 1: Global FDI into African Cities

The report empirically explains the networks of FDI that bind African cities into the world investment system, using GIS, network analysis and econometric techniques. The spatial structures, trends, and forecasts of African FDI are revealed at global, continental, national and urban scales, and show how these impact developments in African cities. The report covers various themes including Chinese FDI into Africa; the impact of investment on inequality, employment and wages; food investment and food security; investment competitiveness, renewable energy investments and climate change. Also, four case studies are explored in-depth by local researchers from Johannesburg (South Africa), Cairo (Egypt), Abidjan (Ivory Coast) and Kigali (Rwanda).

There is a pressing need for more FDI in Africa. Financial and policy interventions are needed to support Africa’s emerging transformations and strengthen the already declining primary sector (resources) investments, towards secondary and tertiary sectors (manufacturing, services and hi-tech). This would facilitate structural economic transformation and generate higher value added productivity on economic activities. In this light, FDI is a key resource to expedite Africa’s growth potential, since it promises to bring not only financial resources, but also new technologies, knowledge and expertise. Investment generally promotes employment, productivity and competitiveness through entrepreneurship in FDI destinations. Substantial private capital injections can, for instance, help close Africa’s massive gap in physical infrastructure, improve the quality of the built environment, and make it a more attractive destination for FDI.

Figure 2: Three Continental Superclusters of Global FDI into African Cities

Some key findings:

- African cities are strongly disconnected from the investment backbone of the world economy. The competitiveness and resilience of African cities will depend on the improvement of regional, continental and global investment connectivity.

- Because African cities are now the fastest growing in the world, African local, regional and continental authorities, need to consciously embrace rapid urbanization and coordinate and collaborate activities across geographic scales, to ensure sustainable development.

- Local governments must ensure that African cities develop a more diverse portfolio of investment sectors, through which these cities can become more internationally competitive.

- African cities are rapidly developing into regional agglomerations. Investments to cities in these agglomerations are unevenly spread. Cities should understand the nature of hierarchical urban systems, and find complementarity, collaboration (co-opetition) and coordination amongst cities.

- There are three continental investment superclusters in Africa. The first is an Anglo-Saxon cluster, the second a Franco-Arabic cluster, and the third a Resource-Port cluster. Johannesburg, Nairobi, Lagos, Cairo, Lome, Port Louis, Luanda and Dar es Salaam serve as the most strategically positioned cities within the global investment system.

- Africa is no longer dominated by investment into natural resources (as is commonly understood), but has been strongly overtaken by knowledge intensive and advanced industry sectors e.g. renewable energy, food, communications, real estate, financial services, business services and IT.

- Since 2003, the source of investments into African cities have increasingly been from distant locations. This means that the geographic investment scope of Africa has expanded tremendously across the globe.

- As an example, Johannesburg’s biggest global investment competitors are Bogota and Chicago. In Africa, these are Cape Town and Casablanca. Its biggest competitors in Asia are Delhi and Manila. In West Europe these are Zurich and Helsinki. These competitor studies have been done for various African cities, and results shown in the report.

- It is shown that African investment is determined by access to growing local markets, physical proximity to regional markets, skilled workforce ability, business trustworthiness, available domestic credit for partnerships, and, governments with progressive forms of democracy. It is also shown that in future, the increased involvement of women in the ‘formal’ labor force will strongly boost future investment.

- It is shown that investment into African cities, such as Johannesburg, tend to reinforce the colonial and apartheid spatial structures of these cities..

- The report shows that Nigeria, South Africa, Zambia, Ethiopia and Tanzania are the main recipients of Chinese foreign investment. The determinants of Chinese investment into Africa are political instability, levels of democracy, market seeking motives, political proximity to China, and economic proximity to China.

- Africa holds the highest wage inequality levels in the world (Gini coefficient). The study finds that FDI in general increases inequality in African countries, unless paired with well-developed technological absorptive capacity in these countries, improved tertiary education, and institutional reliability.

- It is shown that the average minimum wage levels across African cities do not have a significant relationship with the attraction of FDI into these cities. This means that generally wages are not an operation cost, considered by multinationals investing in Africa.

- The report shows that Real-Estate FDI into African cities is determined by the regulatory quality of the cities, urban population growth, the amount of total FDI invested, the control of corruption, the presence of special economic zones. Furthermore, Real-Estate FDI is deterred by rigid town planning policies, and the number of days needed to obtain a building permit.

- It is shown that Africa has the highest food insecurity levels in the world, where these countries are highly vulnerable, due to high volumes of food imports (corn, wheat, rice, pork and chicken), and the exploitation of food multinationals that are mainly geared towards exports to global markets.

- FDI in renewable energy is determined by various energy policies at the country level. These include feed-in-tariffs (price regulation), renewable portfolio standards (inclusiveness of renewables), fiscal measures, energy production payment (government contributions), public investments and carbon tax (fossil fuel imposed tax).

- A study on Smart Cities shows that the smartness of a city is not only determined by the technological measurement and coordination of cities, but particularly by its position within global networks of foreign investment.

- The report shows that besides a city’s level of global competitiveness, based on World Economic Forum indicators, the level of “greenness” measured by Yale University’s Environmental Performance Index, determines the level of FDI that a city attracts. This means that being a green city gives an added advantage in attracting FDI.

Are you currently involved with regional research, policy, and development, and want to elaborate your ideas in a different medium? The Regional Studies Association is now accepting articles for their online blog. For more information, contact the Blog Editor at RSABlog@regionalstudies.org.