Please find the response from the RSA to the consultation by the USS Trustee on the proposed assumptions for the scheme’s Technical Provisions and Statement of Funding Principles relating to the 2018 actuarial valuation:

To: UUK

From: Regional Studies Association

Date: 8th March 2019

Re: A consultation by the USS Trustee on the proposed assumptions for the scheme’s Technical Provisions and Statement of Funding Principles relating to the 2018 actuarial valuation

Thank you for the consultation documents.

We are only a very small institution, and do not have specialist actuaries who can make meaningful responses to the very technical documents that have been circulated, and we do not have enough time to take further advice. However, we appreciate that UUK need to demonstrate support from the employers, in order for USS to agree to the proposals.

Due to the size of our institution (4 members) our responses should only have a low weighting compared to large institutions with many members.

The conclusions of the RSA Board and Management tot the following questions follow:

- We have no specific comments on the proposed assumptions for the 2018 valuation

- We support UUK putting forward a proposal for a CCs arrangement, rather than paying at the upper bookend level

- We find the proposal for a CCs arrangement set out in the Aon note acceptable, to the best of our understanding

We hope that you will find this response helpful.

Yours sincerely,

Sally Hardy, Chief Executive, Regional Studies Association

The context for this response is below. Interested members may contact the Association if they have points to make.

To Vice-Chancellors, Principals and Chief Executive contacts

Dear Colleague

A consultation by the USS Trustee on the proposed assumptions for the scheme’s Technical Provisions and Statement of Funding Principles relating to the 2018 actuarial valuation – final material

Further to my email dated 11 February 2019 regarding the latest developments in relation to the USS trustee’s consultation on matters relating to the 2018 actuarial valuation, I am now able to provide the latest and final material in relation to this part of the 2018 valuation, explain the current context and advise on next steps.

The context

As employers will be aware, the USS trustee has advised UUK that it will require tangible support from scheme employers to back the additional risk associated with moving towards the recommendations for scheme funding put forward by the Joint Expert Panel (JEP). Therefore, UUK has taken up the invitation from the USS trustee to prepare contingent contribution arrangements which meet the trustee’s principles. This is not a position which UUK expected to be in, given the earlier indications from the USS trustee that it would set out the terms for contingent contributions. Making this move, and taking the first step to fully define workable arrangements, demonstrates UUK’s commitment on behalf of employers to achieving an outcome acceptable to all parties.

With the necessary backing from employers, UUK believes that the proposed arrangements represent a credible and proportionate outcome that, with some give and take on all sides, all stakeholders could find acceptable. Crucially, this includes UCU, with which UUK continues to actively engage. The proposals have been developed by UUK in a genuine spirit of seeking this balanced solution. However, I must explain that there is no guarantee the proposed arrangements will be acceptable to the USS trustee.

New material

Earlier this week, Universities UK received further financial data from the USS trustee. This has now enabled Aon, the UUK actuarial adviser, to finalise the development of a proposal for the terms of payment of contingent contributions to the Universities Superannuation Scheme (USS) for consideration by employers.

A copy of the Aon proposal is attached, together with a Universities UK consultation document, which sets out the views of Universities UK presented in the context of achieving a timely outcome for the 2018 valuation. We hope this will be acceptable to all stakeholders. I have also attached, for ease of reference, the first Aon advisory note which we expect will be helpful to employers in considering the consultation material and responding to the questions raised (specifically question 1) in our consultation document. We will then use the employer responses to the consultation to formally respond to the USS trustee in our capacity as the employers’ representative body for these purposes as set out under the scheme rules.

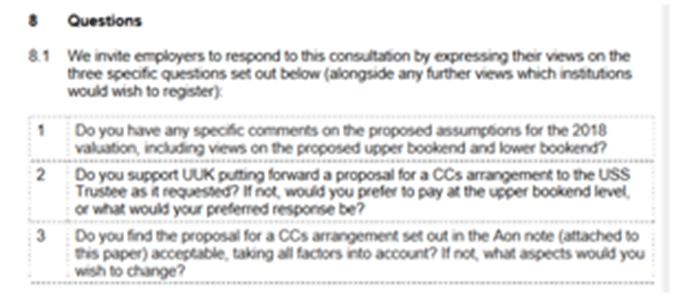

Action for employers

Please carefully consider the consultation material attached, together with the material previously provided (links to this material are provided in the UUK consultation document), and respond to the consultation on behalf of your institution to pensions@universitiesuk.ac.uk. Specific questions have been provided within the UUK document which we would invite employers to respond to, together with any further comments employers would like to make.

The closing date for the USS consultation with UUK on these issues is 15 March 2019; UUK would welcome the comments of employers by 13 March 2019, if possible, so that a collective response from employers can be provided to the USS trustee by the deadline.

Employers are asked to provide responses which represent the view of the institution. Whilst we recognise that this is a challenging timescale, employers are encouraged to engage with their governing bodies in framing their responses.

If you require any further information, please contact me at pensions@universitiesuk.ac.uk.

Best wishes,

Stuart