Bruno D. Castanheira works with the European Commission in securing the Union’s financial interests, having previously worked to improve implementation of Regional Policy. His research to stabilise European Economic Integration explored new approaches to Regional Policy and the role of financial instruments in Cohesion founded on behaviourist, industrial and financial economics. You can find him on twitter at @BrunoDuarte_, or connect with him on LinkedIn or his own blog.

The need for a convergence budget

Stephen Gross’s review of the industrial relations in Central Europe details how the European Union (EU) was instrumental to shaping today’s economic landscape. Germany’s Ostpolitik enacted by Chancellor Willy Brandt leveraged mutual acknowledgement of post-WWII borders, delivered development assistance and foreign direct investment – and set the basilar stones of German economic dominance in Europe.

As Professor Gross narrates, the technical and industrial treaties signed in the 1970s sought to both stem the Visegrad’s “import hunger” and finance Visegrad’s inputs to German value chains through cooperative industrial enterprises using German technology. While these earlier economic ties were relevant, it was the EU’s decision to extend its outward processing traffic regulations eastward that shaped today’s Germany-Visegrad industrial relation similarly to that of the United States and Mexico: the Visegrad became Germany’s suppliers of “crucial stages” of manufacturing at low labour costs and therefore of German export competitiveness.

Although the Euro is yet to replace the zloty, Peter B Kenen’s framework on the role of industrial diversification in preventing asymmetric shocks in a Currency Union seems adequate to assess the need for a Eurozone budget in this context. German firms export most of the 70% of Visegrad’s exports originating in foreign firms; while Hans-Wener Sinn (quoted above in Gross) asserts that Germany’s industrial policy of delocalisation and export financing leads to investment dearth and chronic economic dependence of European contractors.

The diversification capable of delivering economic resilience to asymmetric shocks implies geographical dispersion of both high-value industries and activities – that is, Member-States’ optimal industrial structure should neither be restricted in variety (inter-industry) nor in quality (vertical intra-industry) but rather integrate competitive regional inputs to maximise high-value added output, as explored in a blog post I penned to the RSA. This type of economic integration, termed horizontal intra-industry, results in narrow discrepancies between exported and imported value added between Member-States that smooths incomes and promotes convergence.

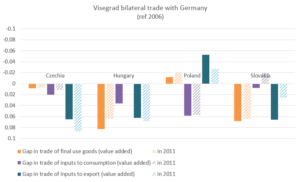

It is possible to identify different strategies in the East value chain (Visegrad and Germany): for instance, Czechia and Hungary input more value-added to German exports than Poland; Poland exports more value-added both to final consumption and as input to exports than it imports from Germany. Prima facie, Poland and Czechia achieve horizontal intra-industry integration with Germany in final use goods but exhibit significant surpluses and deficits in value added of inputs to domestic consumption and to export, respectively.

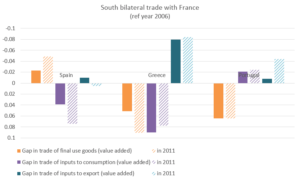

The South value chain (France’s exchanges more value added with Spain, Portugal and Greece), where the currency is exclusively the Euro, is quite different in structure. Greece maintains a current account deficit with the hub, France, while Spain significantly complements French firms in supplying consumption goods to the French economy. Portugal’s role in the value chain is closest to horizontal intra-industry integration, exhibiting narrow gaps in value added with France, exporting value to domestic consumption and export goods while importing final value added goods from the Gallic economy. In 2011, a positive gap meant that Portugal converged with France, at least in terms of value added.

Historical ties such as those established between Germany and Visegrad imply varieties produced and skill employed in Visegrad better match German demand. When integrating inputs from these four Member-States, German firms benefit from lower input costs at the expense of lower wage premium and thus of lower domestic investment, as Hans Werner-Sinn argues. German firms also benefit from a larger market, as do French firms – resulting in a persistent aggregate value added deficit of those Member-States supplying inputs to larger Member-States, as Bacchiega explains.

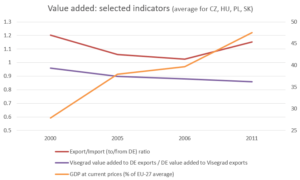

As Member-States converge, the benefit drawn from transnational value chains also evolves. While the non-weighted average GDP per capita (as a percentage of the EU-27 average) in Czechia, Hungary, Poland and Slovakia grew from 27% to 47% (right axis in the chart) since 2000, the Visegrad countries increasingly integrated more German value added in their own exports, while also exporting more to the Teutonic economy. Eroding gains from cheaper inputs or from expanding markets may have spurred Finance Minister Olaf Scholz’s joint proposal for a Eurozone budget that fosters convergence and increases income per capita, to bolster both German exports to Visegrad markets (namely, Slovakia) and inputs to Visegrad value chains.

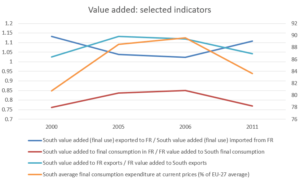

France’s Finance Minister Bruno le Maire, who co-authored the proposal, is admittedly more concerned with the stability of the Eurozone. Although firms located in Member-States significantly affected by the recession that started in 2009 are suppliers and clients in France’s value chain, the ratio of value added by South firms was not at stake: France is still a dominant (albeit declining) customer of South’s value added. The decrease in Southern countries final consumption expenditure (right axis in the chart) converted customers to suppliers. Arguably, the steep decline in final consumption expenditure affected South firms’ investment and eroded the value of South’s inputs to French value chains causing instability in value chains.

The Eurozone Budget’s architecture links reform needs identified in the European Semester with Eurozone stability and convergence, the topic of the following post.

Are you currently involved with regional research, policy, and development, and want to elaborate your ideas in a different medium? The Regional Studies Association is now accepting articles for their online blog. For more information, contact the Blog Editor at RSABlog@regionalstudies.org.