This study captures the twin process of urbanisation and real estate growth in India as inextricably linked process affecting the urban development and management of resources and spatial planning. The aim here is to examine the possible implications of COVID-19 pandemic and the process of recovery and revival of real estate sector in India.

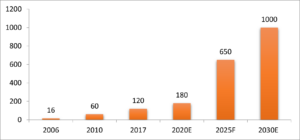

The real estate sector is one of the most recognized sectors globally, comprising of four sub-sectors: housing; retail; hospitality; and commercial. The Indian real estate industry is deemed to be one of the biggest wealth creators in the past few decades and is the second-highest employment generator in the country after agriculture. The sector is deeply interlinked to as many as 220 allied sectors. The real estate industry supports close to 250+ ancillary industries in India, accounts for nearly 6-7% of the total economy and is set to account for nearly 13 percent by 2025 (Figure 1).

Figure 1: Market Size of Real Estate in India (US$ billions)

Since the post liberalisation during the 1990s, Indian cities have witnessed spectacular growth by infusing capital into real estate and concomitantly drew the attention to the speculation and capital accumulation. With the change of political regime in 2014, three dramatic events related to economy drastically impacted the real estate sector in India:

- Implementation of demonetisation

- Introduction of GST

- Pandemic-related restrictions

From an economic perspective, the three waves of lockdown, post pandemic inflationary spike, high cost of living, high unemployment rates in urban centres and volatile consumer decisions led to severe setback for the real estate. The emergence of the COVID-19 pandemic as a global phenomenon and subsequent lockdowns in 2020 had a devastating impact on society and economy alike, with specific impacts on real estate in particular. Both economists and policy analysts were grappling to analyse the implications and fathom the future. Distinctive patterns of work, work from home (WFH) mandates, creation of new office spaces and study rooms, social precautions and physical distancing drastically impacted how we interact and socialise with others. All these practically changed the way people interact and inhabit physical space creating unprecedented crisis for the real estate industry. Especially in India, in the last two years – real estate was thrown into disarray by disruption in supply chain, low budget, labour scarcity, and halted construction activities.

Drivers of Real Estate in India and Current Research

Some of the key drivers of real estate sector in India are urbanisation, population growth, rise in ‘nuclear families’, rise in disposable income, availability of finance and so on. Due to the urban-rural nexus, business activity has shifted from Central Business Districts (CBDs) to Secondary Business Districts (SBDs) leading to a boom in real estate investments and activities. Especially in urban centres, some of the noticeable trends were marked by rapid growth of service sectors like IT-BPO, BT corporate, and MNCs which subsequently increased the demand for office or co-working space in mega cities of Bengaluru, Hyderabad, Mumbai and New Delhi redefining the nature of real estate models and growth.

Such urban clustering of talent and growth is referred to as “agglomeration economies”. Responding to emerging urban trends, real estate has moved to periphery (sub-urban) regions, and smaller cities, turning adverse impacts of the pandemic into an advantage. It is reported that since 2016, over 40 percent of real estate investments are targeting non-metro cities such as Pune, Greater Noida, Chandigarh, and Amristar in North, and Vizag, Coimbator and Kochi in South India.

Figure 2: Real Estate in Bangaluru

Now over two years since the onset of the COVID-19 pandemic, some of the structural factors facilitating the continued shift to an increase in real estate in ‘tier 2 & 3 cities’ include:

- The cost of doing business per sq.ft is lower in tier 2 and tier 3 cities in India

- Both tier 2 & 3 have emerged as prospective hubs of logistics and warehousing

- Availability of affordable and quality housing

- Constituting industrial corridors promoting seamless connectivity

- The government has plans to open more airports and develop 1000 new routes connecting smaller cities/towns

- Change in preference of NRIs –opting to invest in smaller cities with a dual objective to cater to WFH and explore the possibility of own future living

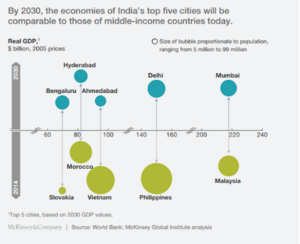

The growth of real estate sector is complimented by the emergence and growth of corporate environments accompanied by the demand for office space as well as urban and semi-urban housing. The construction industry ranks third among the 14 major sectors in terms of direct, indirect, and induced effects in all sectors of the economy. In India, the real estate sector is the second-highest employment generator. The city of Bengaluru (South India) is expected to be the most favoured property investment destination for NRIs, followed by Ahmedabad, Pune, Chennai, Goa, Delhi and Dehradun. The Government of India has now initiated policy reforms impacting the priority sectors of real estate in 2021-22: housing (especially affordable housing), industrial & logistics, data centres (DCs) and e-commerce (Figure 3).

Figure 3: India’s Top Five City Economies

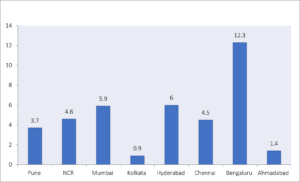

Further, the flexibility of workspace or co-working space is witnessing a steady growth especially in metro cities with shorter and more flexible lease terms. It is reported that during the third quarter of 2020, the gross leasing volume increased by 138 percent to 14.7 million sq.ft which is followed by increase in demand for commercial space driven by various sectors (Figure 4).

Figure 4: City-wide Demand for Commercial Space (Million Sq.ft) – 2020

As we continue forward since the onset of the COVID-19 pandemic, it is reported that the real-estate sector will continue moving in a positive direction, with low rates, the promotion of affordable housing and state stimulus expected to contribute to the revival of the real-estate sector in India in its next transformation phase.

Dr. K.C. Smitha is an Assistant Professor with the Centre for Social Sciences and Education (CeRSSE) with the School of Humanities and Social Sciences at Jain (Deemed-to-be-University).

Are you currently involved with regional research, policy, and development? The Regional Studies Association is accepting articles for their online blog. For more information, contact the Blog Editor at rsablog@regionalstudies.org.