The Chinese Belt and Road Initiative (BRI) is currently the largest global investment initiative into infrastructures. In this blogpost we present the actor constellations behind two exemplary Chinese funded road infrastructures in two major BRI projects.

To realise the BRI, China makes use of several investment and delivery arms to fund projects, which allow to respond to different institutional settings. At the same time, they come alongside different conditions for the implementation process. Some of the key banks and companies for the BRI are

- international financial institutions such as the Asian Infrastructure Investment Bank (AIIB) or the Asian Development Bank (ADB)

- Policy Banks such as the China EXIM Bank

- State Owned Bank such as the Bank of China

- State Owned Enterprise such as China Three Gorges

- State Owned Fund such as the China-CEE Investment Cooperation Funds. (own differentiation drawing on Klecha-Tylec, 2021).

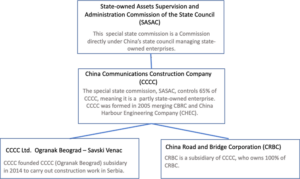

To exemplify the structures behind the implementation of BRI projects, we present visual representations of the stakeholder constellations. For this purpose, we build on two projects, the Batumi Bypass in Georgia funded through the AIIB and the ADB, and the Preljina-Pozega section of the Serbian E-763 highway funded by China’s EXIM Bank. China’s EXIM Bank is an 100 % state-owned bank, whereas the ADB and the AIIB are international banks with Chinese stakes. In the case of the AIIB, China holds 26.6 % voting power (NEW), in the case of the ADB China holds 5.8 % voting power. A main delivery arm of the BRI is the China Communication Construction Company (CCCC), which is partly state-owned. The CCCC acts as an intermediary with contractors. It is also the parent company of the Chinese Road and Bridge Corporation, which participates in the actual construction process (see Fig. 1).

Fig. 1. Structure of CCCC, own illustration

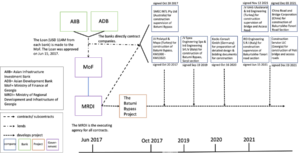

In the case of Georgia, the Batumi Bypass project consists of a 14,3 km long two-lane road, and is designed for a maximum vehicle speed of 100 km/hr. The road links Batumi to the countries most important road, the East-West Highway shortening driving time to Tbilisi, Georgia’s capital. It also connects Batumi with Poti, the largest port of Georgia as well as Kobuleti, a popular holiday resort. The loan of the ADB And the AIIB for the project was approved in June 2017, with an aspired completion date of December 2022; though construction is continuing. Figure 2 illustrates the main involved financing institutions, governmental institutions, and contracting companies. In this project the China Road and Bridge Corporation is only one of the contractors, among many other international contractors from Australian companies to Georgian contractors.

Fig. 2. Batumi Bypass stakeholder constellation, own illustration

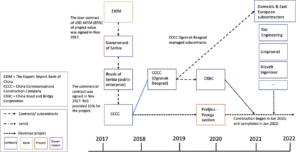

In the case of Serbia, the E-763 highway is the major North-South roadwork, also known as the lifeline for Serbia’s road transport. The whole length of the E-763 highway is 258 km, extending from the capital Belgrade to the border of Boljare, Montenegro. In our research we focussed on the stakeholder constellation for the implementation of the section Preljina-Pozega (see Fig. 3). This section is 31 km long with about 10 km of bridges and tunnels. To construct this section, the Serbian Ministry of Finance acquired a loan from China’s EXIM Bank to finance a contract with the CCCC for the construction works. The latter then contracted the China Road and Bridge Corporation as well as domestic and East European subcontractors (for example see CCCCLTD Ogranak Beograd, 2022; Geoslpro, 2023; Caranović, 2022).

Fig. 3 Highway E-763, section Preljina-Pozega, own illustration

Looking at these cases, it is obvious that for road projects the CCCC with its subsidiary of the China Road and Bridge Corporation is of high relevance. We contend that what role the CCCC acquires is dependent on the funding institution. In the case of the AIIB/ADB funded project the China Road and Bridge Corporation is one of many companies receiving funds. In the case of the Chinese EXIM bank, the role of CCCC is much more central and includes the overall management of the whole project. This is in parts possible as Serbia required the opening of a subsidiary called CCCCLtd. Ogranak Beograd.

To conclude, each project implementation is different. Yet, the direct involvement of Chinese companies in the projects differs depending on the funding. The picture presented in the cases here is representative of many BRI projects. We cannot determine to what extend working with a state-owned policy bank such as the EXIM bank, creates a lock-in to specific contracting firms. Yet, we suggest that receiving countries are well advised to explore opportunities for including other contractors in these processes. These examples also showcase the versatility of Chinese companies to adapt to national contexts.

Siyi Huang, BA, is an MPhil Student in Planning, Growth and Regeneration at the Department of Land Economy, University of Cambridge.

Franziska Sielker (Twitter @FSielker) is a Professor of Urban and Regional Research at the Department of Spatial Planning and Architecture at TU Vienna and Affiliated Professor at the Department of Land Economy, University of Cambridge.

Are you currently involved with regional research, policy, and development? The Regional Studies Association is accepting articles for their online blog. For more information, contact the Blog Editor at rsablog@regionalstudies.org.