Dr. Christian Sellar (top left) is an Associate Professor in the Department of Public Policy Leadership at the University of Mississippi.

Dr. Silvia Grandi (middle left) is an Adjunct Professor in the Department of Statistical Sciences at the University of Bologna.

Dr. Juvaria Jafri (bottom left) is a Lecturer in International Policy Economy at City, University of London.

Financial geography has become a growing, and increasingly distinct, branch of economic geography over recent years. These patterns have much to do with the phenomenon known as financialisation, and financial geographers have sought to understand how space and place matter for the processes and relations of finance. As Barnes and Christophers (2018) observe, scholars of financialisation are conscious that finance plays a crucial role in shaping the choices of ordinary individuals about their daily lives; but also in shaping the decisions of corporations, not only in their day to day operations but on how they deepen and widen their income streams. Over the last two decades, financial corporations have seen their profits and influence surge, but non-financial corporations now too rely more on dividend or interest income, as a portion of their overall profits.

The implications of these trends — spatial and otherwise — are well documented for what is sometimes described as the ‘core’ of the global financial system. This core is Anglo-American; while major financial centres do exist outside of the United States and United Kingdom, the importance of these is affixed to their close ties with New York and London. We note in Grandi, Sellar, and Jafri (2019), that while the literature on heterodox finance has resisted this fixation, geographers have tended to write about the core; more specifically, its public and private sectors. In choosing to focus on what we describe as the ‘semi-periphery’ we capture perspectives on what are not usually the best known governments, global investment, consulting, and insurance firms.

To make this possible we sought contributions from scholars whose work placed finance in the context of politics, and also firm and household behaviour. We were particularly keen to engage with studies centred outside of the major financial hubs of the United States, United Kingdom, Western Europe, and East Asia. In doing so and collating studies on a range of countries — including Brazil, Bulgaria, Italy, Pakistan, Russia, Turkey and Vietnam — our project took on the objective of representing what had been previously underrepresented through a process of contributor driven theorisation. This objective was bolstered by the analytical framework of ‘geofinance’ or ‘geobanking’; these interchangeable terms capture the political-geographical nature of finance.

So for instance, the case of Bulgaria, discussed by Elena Stavrova, shows how deepening financial intermediation in the 1990s through the privatization and foreign ownership of banks drove instability and crises which included bank panics and skyrocketing inflation. In Brazil, as shown by Fabio Betioli Contel, stock exchanges, banks, and financial services firms shape the urban prominence of São Paulo relative to Brasilia and Rio de Janeiro. And, Engin Yilmaz’s study of Turkey reveals how dollarisation pulled bankers away from deposit taking activities and drove an accumulation of household and corporate debt.

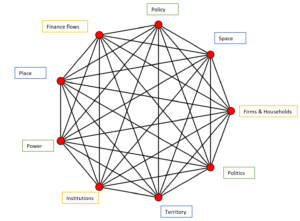

To theorise these patterns we identify, as shown in the figure below, nine entities. Standard features of either political or financial geography, these are consolidated through a framework of geofinance; this connects power, politics, and policy, with space, place and territory. Thus, the polygon below emerges when three triangles overlap to show where political and economic geographies are mediated by finance.

We are eager to expand the reach of this geofinance lens over the coming months and welcome further engagement with scholarship that remains under-represented. Please do get in touch with us if you would like to collaborate with us over online seminars and workshops.

Figure 1.2 from Grandi, Sellar, and Jafri (2019)[1]

[1] This figure is available in the open access chapter from the publication: https://www.elgaronline.com/view/edcoll/9781789903843/9781789903843.00007.xml

Are you currently involved with regional research, policy, and development, and want to elaborate your ideas in a different medium? The Regional Studies Association is now accepting articles for their online blog. For more information, contact the Blog Editor at RSABlog@regionalstudies.org.